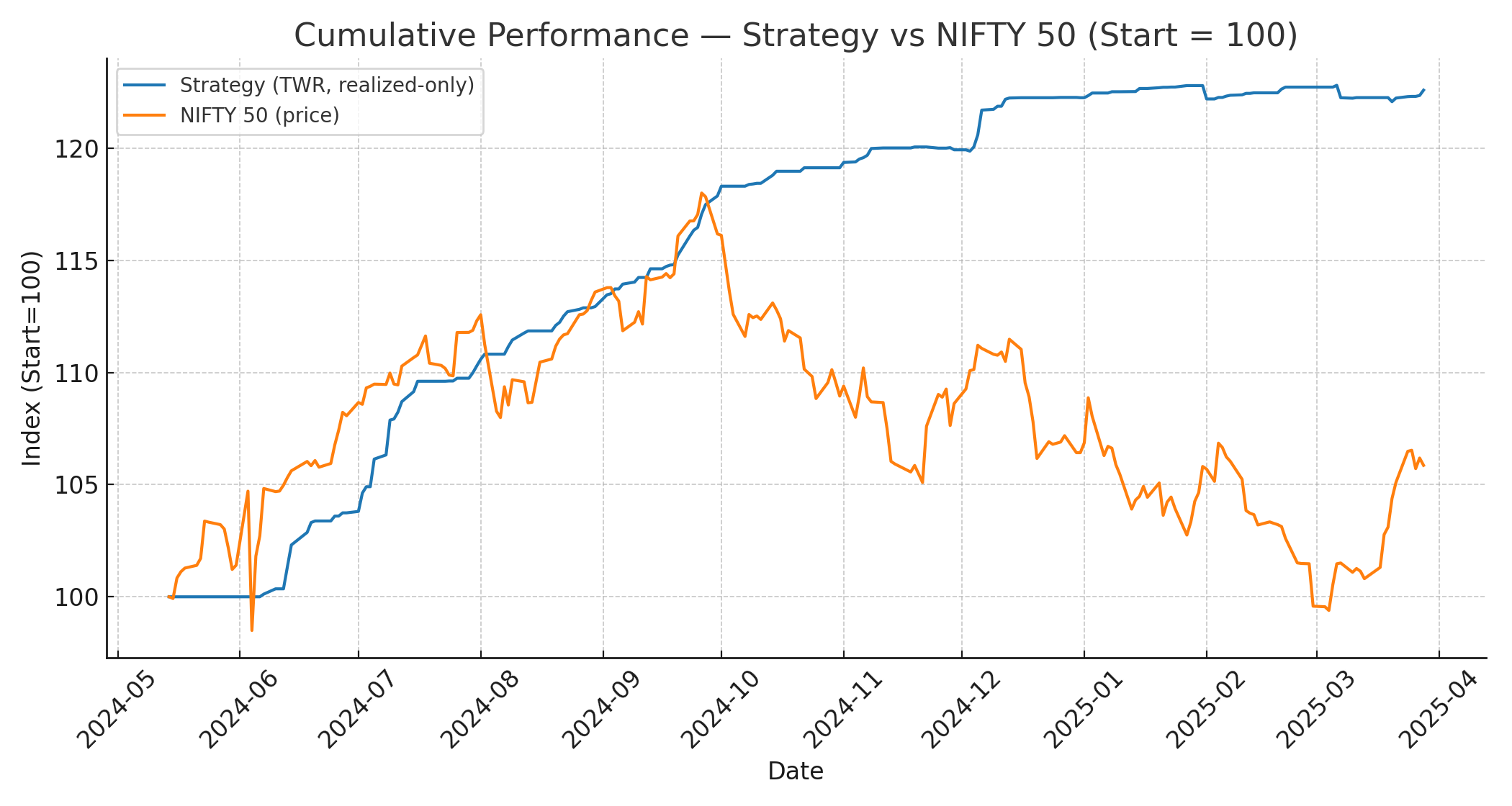

Verified client performance

TWR outperforms NIFTY 50

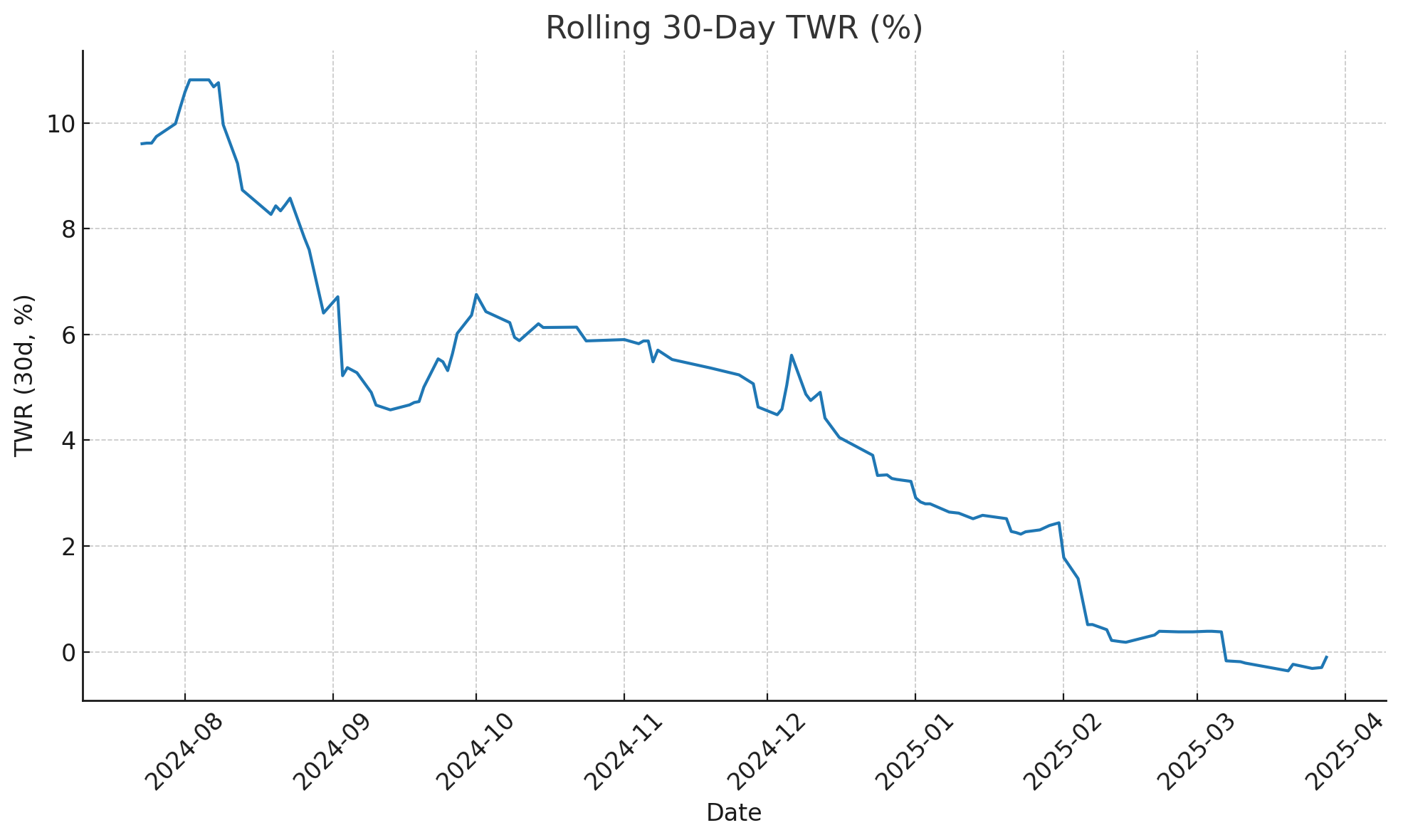

2024-05-14 → 2025-03-28. Numbers are flow-neutral Time-Weighted Returns (TWR), using broker bills and ledger cashflow files. No MTM, no derivatives.

TWR (desk)

22.58%

NIFTY 50

5.86%

Excess 16.72%

Winning days

71.03%

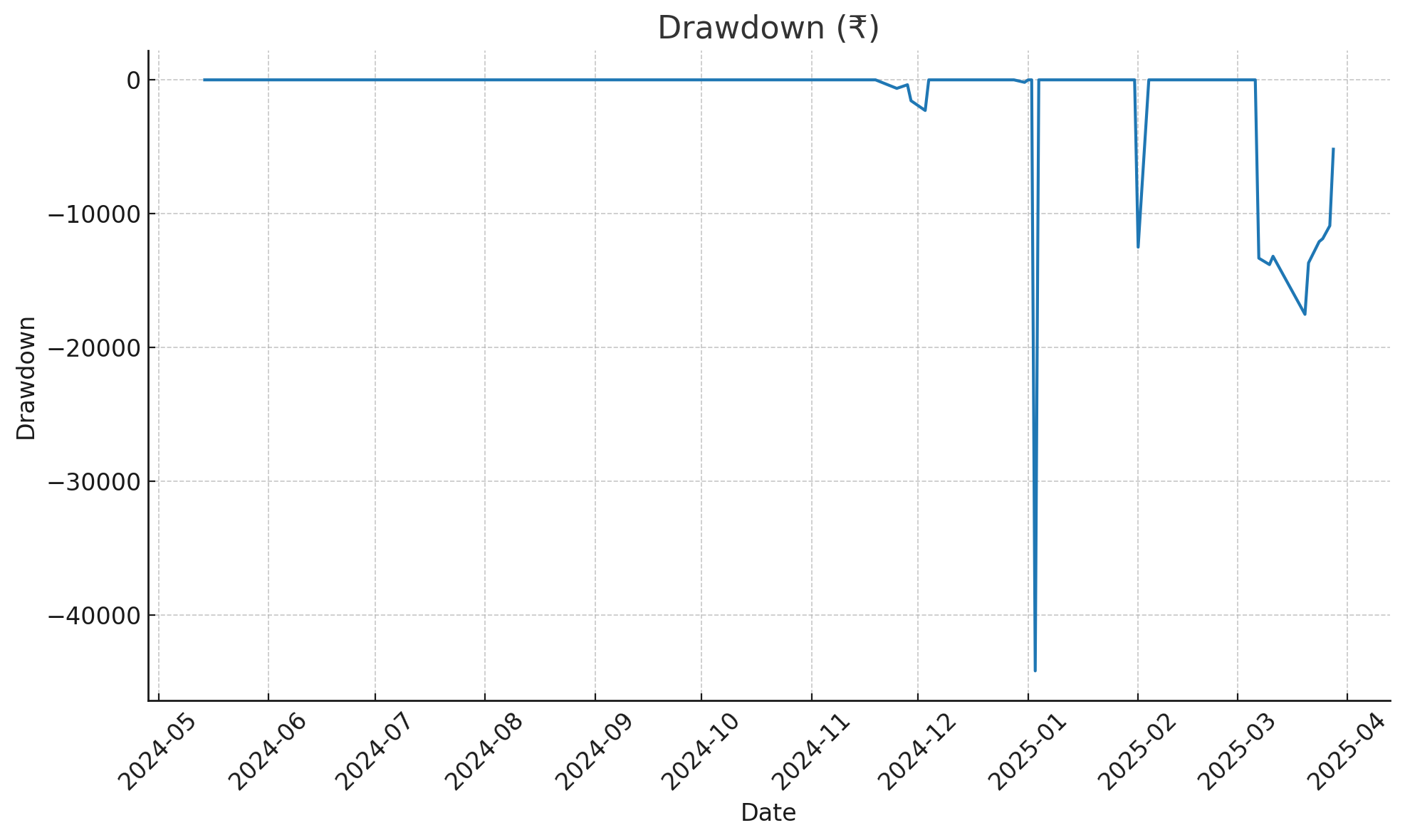

Max drawdown

-2.48%

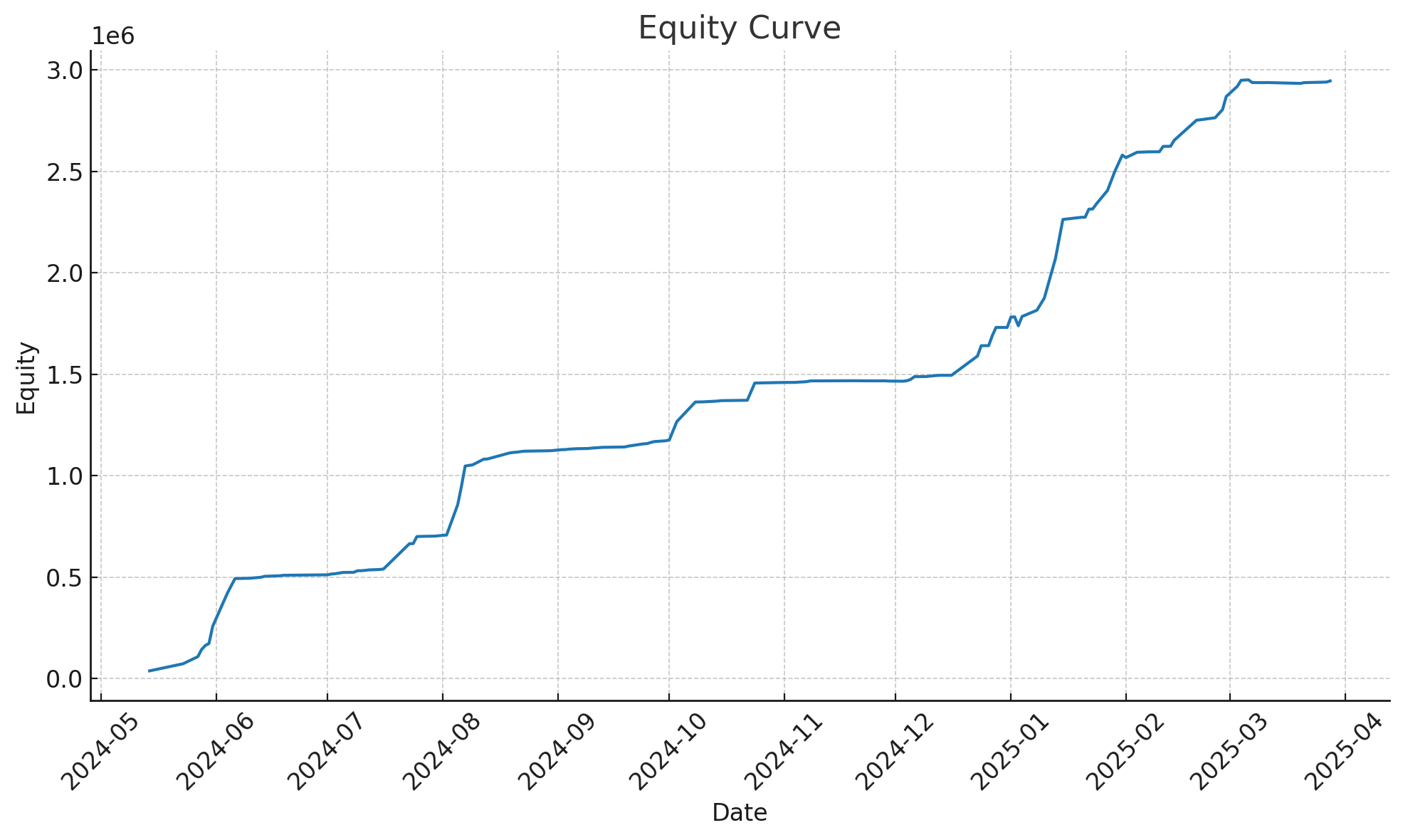

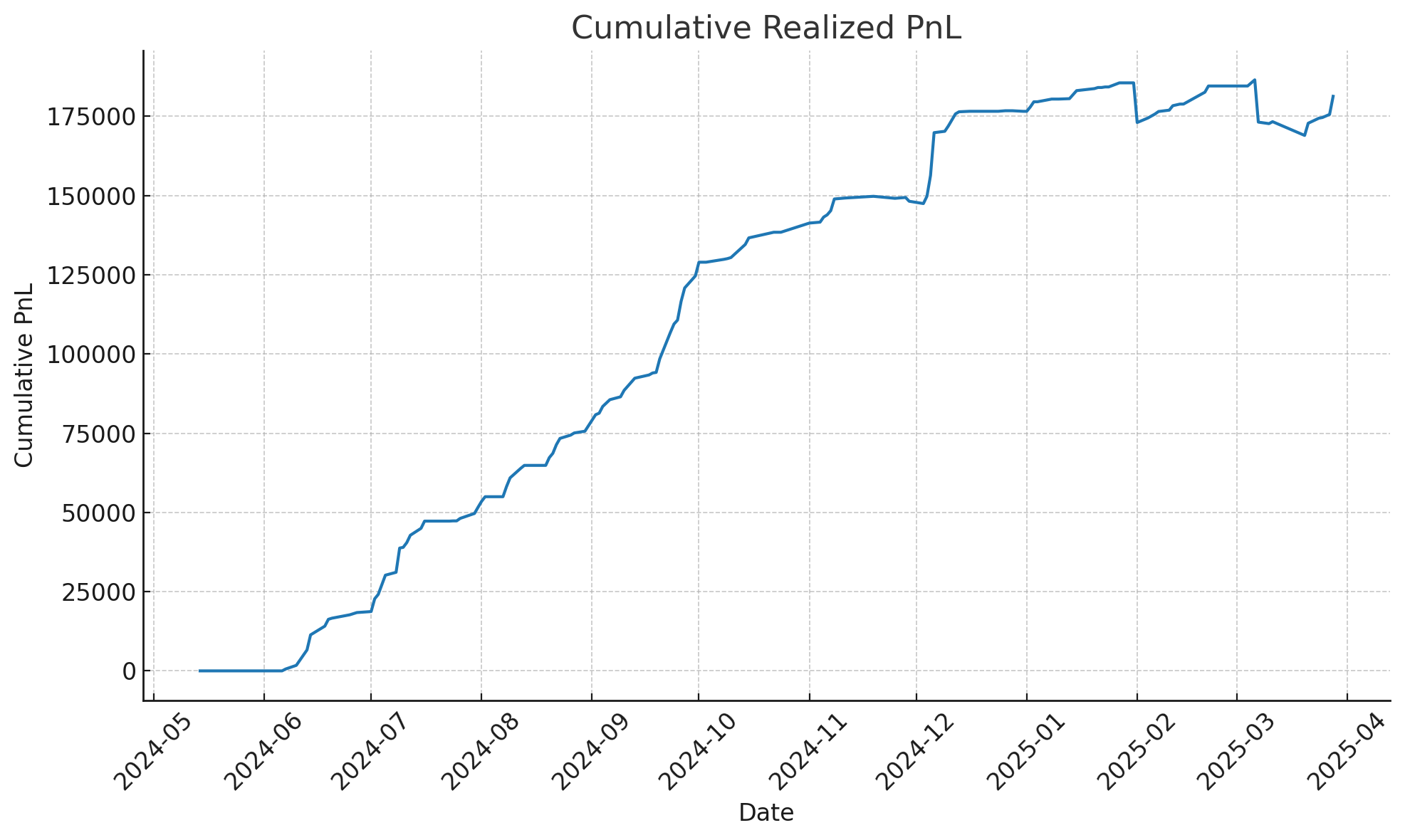

Charts at a glance

These are realized-only views pulled from broker bills. No synthetic MTM. Each chart is available on request as part of the proof pack.

Verification stack

- Source of truth: broker contract notes + bank ledger exports.

- PnL engine: strict FIFO per symbol, short reconciliation, realized-only.

- TWR math: daily realized PnL ÷ start-of-day equity, compounded.

- Benchmark: NIFTY 50 spot closes, normalized to 100 on 2024-05-14.

Charts only are public; raw files stay private. Request a proof pack if you need sample bills, ledger extracts, and checksums.

Proof ID · a64d988b4e

TWR in one minute

- TWR strips deposits/withdrawals so you see pure strategy skill.

- Daily return = realized PnL ÷ start-of-day equity. We compound those values.

- If desk TWR > index return for the same dates, we outperformed.

Ready to deploy?

Start with Telegram signals or plug into full automation with Flattrade / Shoonya APIs.